Driven by strong shipments from homegrown brands in earwear and watches, India’s wearables (smartwatches, wrist bands and earwear) market grew 118.2% year-over-year (YoY) in 2Q21 (April-June). It is in continuation of the good show in the previous quarter. The second wave of Covid-19 had a marginal impact as the overall wearable shipments declined by 1.3% sequentially in 2Q21.

Overall, it shipped 11.2 million units, according to International Data Corporation’s (IDC's) India Monthly Wearable Device Tracker.

Smart watches continued to be the fastest-growing category accounting for 81.2% share in the wristwear category that includes watches and wristbands, up from 35.0% a year ago. The earwear category also maintained its momentum, doubling its shipments in 2Q21 and remains the largest category in wearables.

- Samsung announces new 5nm processor for wearables

- Best smartwatches under Rs 15,000 in India for 2021

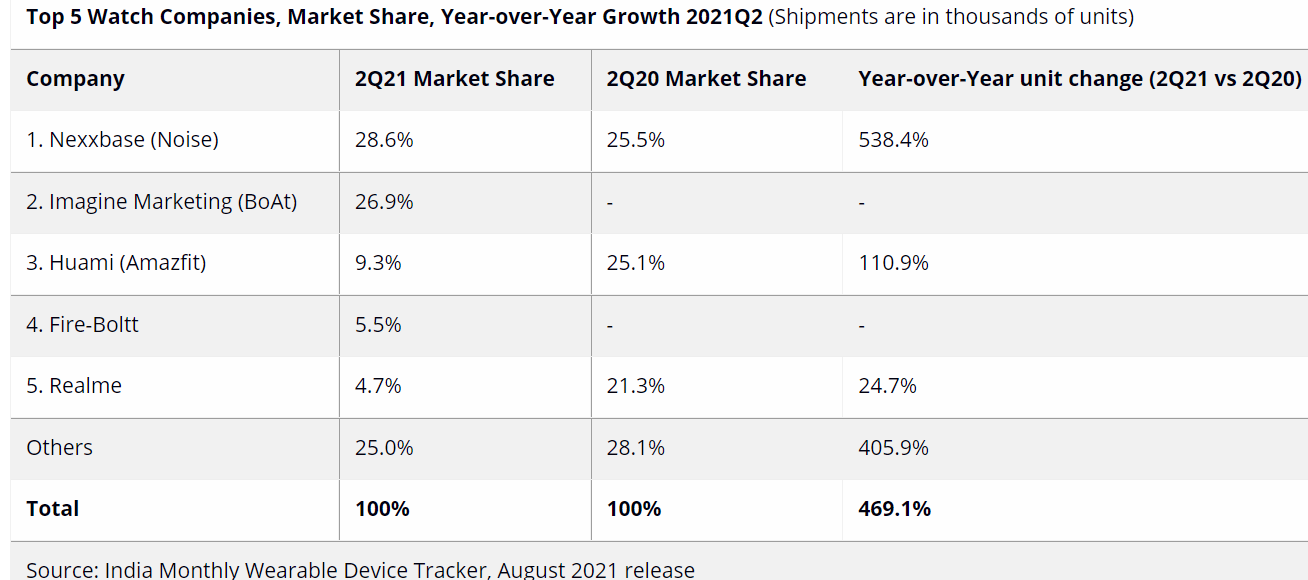

Noise, the leading player in watch segment

IDC said the watch form factor seems to be appealing to the consumers, and Indian brands have been quicker to leverage this trend and align their device portfolio. Among the top five brands, three spots are captured by Indian brands. Noise continues to be the leading player in the overall watch category for five straight quarters with a 28.6% share in 2Q21 and closely followed by BoAt with a 26.9% share. Fire-boltt, another homegrown brand, has entered at fourth position in just three quarters of starting its business in this category. For the record, Huami and Realme are at 3rd and 5th positions, respectively.

However, Xiaomi maintains its formidable lead in the wristband category with 38.9% share, followed by Oneplus and Titan with 21.7% and 21.3% share, respectively.

“Affordability has been the key for Indian brands, and these brands have been immensely successful in gaining a significant portion of the watch market with competitive pricing, aggressive marketing, and faster adoption of new features,” says Anisha Dumbre, Market Analyst, Client Devices, IDC India.

“This new generation of homegrown brands are digitally native, aware of their limitations and selectively targeting the gaps. However, they need to be watchful of the China-based brands, who going forward will be aggressive by introducing more sub-brands and leveraging the ecosystem play,” added Dumbre.

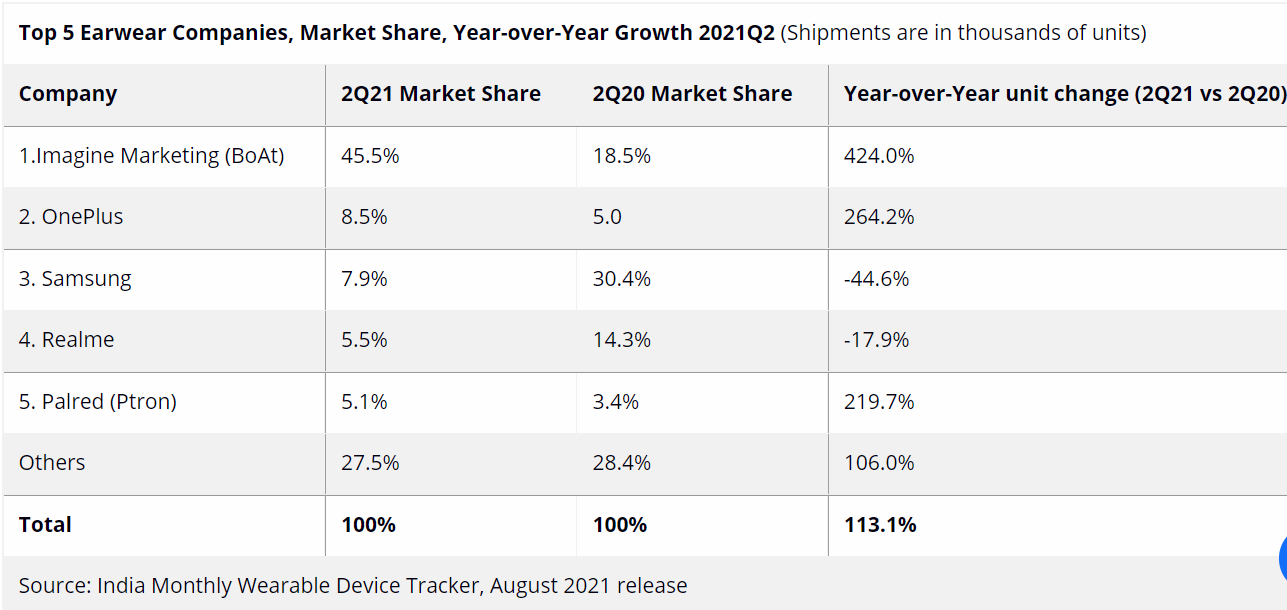

BoAt tops earwear segment

The earwear category grew by 113.1% YoY in 2Q21, shipping 9.2-million-units. BoAt's aggressive shipments and diverse portfolio helped it gain a dominant 45.5% share in 2Q21. It also led the TWS category with a 39.6% share in the quarter. OnePlus finished second with an 8.5% category share in the second quarter of this year.

Even in the earwear category, the homegrown brands have a strong dominance as their share has reached 71.5% in 2Q21 from just 31.2% in 2Q20. Ptron, Zebronics, Noise, Portronics, Boult Audio, and Truke were among the key prominent brands that supported the dominance of homegrown brands in this category.

from TechRadar - All the latest technology news https://ift.tt/38i3Wpm

No comments:

Post a Comment