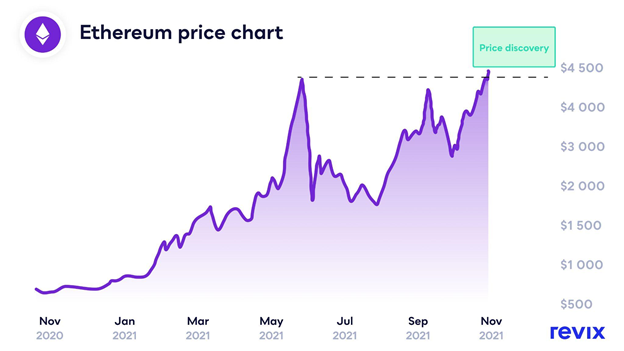

The graph below shows that Ethereum has just broken its all-time high and is going on to discover a new price. The area above the current price indicates the area of price discovery.

If you engage with any crypto social media, you’ve likely encountered the term “alt season” all too often. Unfortunately, many analysts have developed the habit of hailing the beginning of an alt season every time their favourite cryptoasset jumps by 5%, sending false signals and leaving the rest of us uninformed about whether alt season is actually upon us or not. Despite this, alt seasons are a real phenomenon in the world of crypto - understanding when they come around and how to invest in them can prove to be an essential skill on your investment journey.

With Etheruem posting a new all-time high and several large-cap altcoins right on its heels, the exciting news is, it looks like 2021’s alt season really is kicking off. So, let’s get stuck in and find out what an alt season is and how you can make the most of it as a crypto investor.

The crypto birds are singing

While it might still be too early to call this an alt season, many signs are suggesting that alt season is well on its way. The most important of the early signs being Ethereum’s price rally. ETH is well-known for being the “first mover” and a catalyst for an incoming alt season.

Have we just seen the “first mover” come to life?

In the past week, Ethereum set a new all-time price high, and with that, Ethereum went into what many traders call “price discovery”. Price discovery is simply the time when a cryptoasset breaks a previous all-time high. It is, therefore, “discovering” its new price and, with that, its new all-time high. Price discovery is a very bullish phase in the life of any asset, during which there is very little data available to predict how high the price might climb.

This year we’re seeing several large-cap altcoins keep pace with Ethereum’s run rather than waiting in the wings for the next stage in the price cycle. If this trend continues, Ethereum entering price discovery could see several altcoins setting their own all-time highs, just like Solana has done this week.

With two of the most prominent altcoins by market cap posting all-time highs in the same week, could this be yet another sign that alt season is upon us?

What happens in alt season stays in alt season

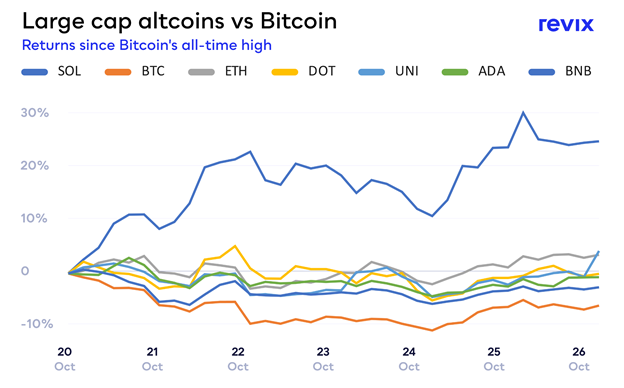

So why should the average investor care about the advent of alt season? Well, if you like simplicity, the graph below deserves your attention.

This graph shows returns on Bitcoin and 6 of the most important large-cap altcoins since Bitcoin broke its own all-time high earlier this month. As the graph shows, Bitcoin has underperformed all 6 altcoins over this period. While somewhat simple in nature, this Bitcoin underperformance is a key trait of an alt season and yet another sign that an alt season could be on the horizon.

What’s different this year is that so many large-cap altcoins are moving together, rather than giving Ethereum its time in the spotlight first. This is a hugely significant shift from historical patterns and a clear indication that Ethereum now has serious competitors in the DeFi space.

Am I too late to celebrate alt season?

If the alt season has already started, surely it’s too late to invest, right? Not if history has anything to say about it.

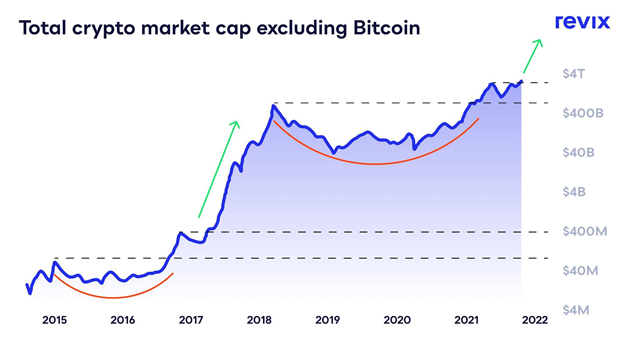

The graph below shows us the total crypto market cap - or the total value of all cryptoassets - excluding Bitcoin. In other words, the line shows the value of all altcoins combined over time.

At first glance, it’s clear that this graph is following some sort of repeating pattern. We can see startling similarities between the two periods in question, namely, 2014-2018 and 2018-present.

The 2014-2018 period shows an accumulation phase (red line), followed by an alt season (2017 price rise). We can see from the above graph that a similar accumulation phase has taken place in the 2018-2021 period. What’s more, we are currently in the same stage of the crypto price cycle as we were when the 2017 al season kicked off.

If the pattern continues to follow the shape laid out in 2014-2018, then it could mean that this is only the beginning of yet another alt season.

So how can you get involved?

With so much action in the altcoin space, it’s clear that deciding where to invest in this phase of the crypto price cycle has become more complicated than it was just a year ago. We’re in the midst of a flat out race to see who will be the first to genuinely challenge Ethereum’s position as the second biggest cryptoasset by market cap, and investor opinions on the matter couldn’t be more polarised.

Deciding what to invest in is hard enough, you don’t need fees weighing you down too!

Don’t worry, Revix is making it easy to get in on the altcoin action.

Revix, a Cape Town-based crypto investment platform, is offering crypto investors a prime opportunity to add the top-performing large-cap altcoins to their portfolios.

******* Zero Fees on purchases *******

Between the 5th of November and the 11th of November, you’ll pay zero fees when you buy Solana, Cardano, Uniswap, Polkadot or Binance Coin in ZAR or GBP.

Back the altcoin you think is going to change the world, take a diversified approach. Either way, you pay no buying fees.

Revix is backed by JSE listed Sabvest and offers access to all of the individual cryptocurrencies we’ve mentioned in this article, such as Bitcoin, Cardano, Ethereum, Polkadot, Solana and many more.

You can get started with as little as R500. Sign-up is quick and effortless, and you can withdraw your funds at any time.

To learn more, visit www.revix.com.

from TechRadar - All the latest technology news https://ift.tt/3k6qiAq

No comments:

Post a Comment